Our Services

05Real Estate Investment and

Property Management

Diversified Investments

Help Achieve Stable Asset Management

With an accomplishment of over 1000 closed deals, REDAC is one of the few professional firms familiar with the intricacies of the real estate markets both in the U.S. and in Japan. We provide comprehensive investment services including property search, consulting, sale and management.

Features of REDAC Real Estate Investment Services

FEATURE 01

Extensive Experience and Accomplishments

Each investment in U.S. real estate faces different issues depending on the region, type, and market conditions. REDAC has experience in over 1,000 real estate investments throughout the United States, including commercial real estate (buildings and hotels) and residential real estate (condominiums, single-family homes, and buildings), and can provide accurate analysis and advice tailored to your situation and objectives.

FEATURE 02

Comprehensive Services

The key feature of REDAC’s real estate investment services is that we handle everything from the initial investment consideration to the successful completion of your goals under one roof. With 39 years of experience, we deeply understand our clients’ needs and provide trusted advice. Even from Japan, you can manage both investment and property management smoothly through a single point of contact.

FEATURE 03

Professional Expertise and Consulting

REDAC is a subsidiary of Relo Group, Inc. (TSE Prime, Stock Code: 8876). Since its establishment in 1986, we have been providing a wide range of real estate investment services to Japanese investors. We are well-versed in the preferences of investors, including property types and management methods.

The key to successful real estate investment in the U.S. goes beyond language, tax systems, and market knowledge. It also requires a deep understanding of business processes and communication styles. REDAC’s staff are investment professionals with expertise in both Japanese and U.S. business practices. We provide Japanese investors with up-to-date information and advice to help them make informed investment decisions in the U.S.

FEATURE 04

Introduction of Best Selected Properties

For our interested clients, we prioritize sending exclusive property listings via email. These include off-market properties and high-quality investment opportunities available only through REDAC, which have received positive feedback. With 39 years of experience, we carefully vet and select properties from multiple angles, ensuring that only the most reliable options are offered, so you can invest with confidence.

SUPPORT REDAC’s Comprehensive Investment Services range from Advising to Sales

01

Investment Consulting

Our specialists provide an accurate projection considering your specific needs, budget and schedule.

02

Finding Investment Properties

We use an extensive listing database to best match your requirements.

03

Property and Asset Management

Solid property and asset management services based on record of accomplishments.

04

Selling Investment Properties

Sales support to benefit the seller with an accurate assessment of the market.

Why You Should Choose New York as a Real Estate Investment Destination

Why You Should Choose Honolulu as a Real Estate Investment Destination

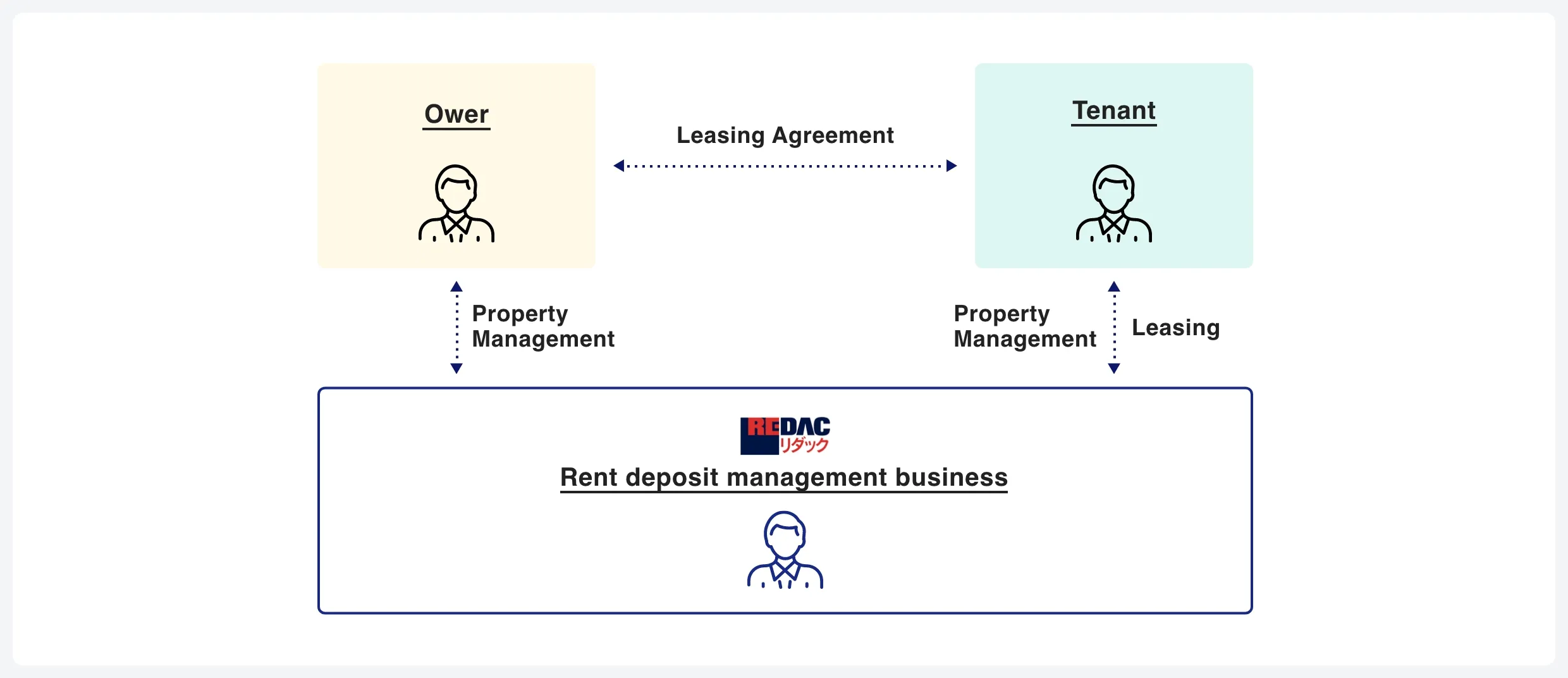

Property Management

Since 1986 we have managed over 1000 various properties. Our services are based on extensive experience, detailed knowledge, and full transparency.

We understand that proper maintenance is an important factor in keeping the value of the real estate investment.

REDAC Property Management Services strive to maintain and enhance property values, protect assets and maximize profit for its investors.

* Some areas are not supported. Please contact us for details.

REDAC Property Management Services

MANAGEMENT 01

Placement of Quality Tenants

In the U.S., both businesses and individuals frequently relocate, making tenant turnover common. Therefore, it’s essential to manage vacancy risks. REDAC leverages its extensive network to introduce expats with relatively long lease terms. Since expat rent is typically paid by the company, these tenants are considered low risk in terms of rent collection. Additionally, upon request, we screen tenants by reviewing their credit history to ensure their payment capability, providing a report to the property owner.

In addition to tenant placement, we handle lease negotiations and all related procedures on behalf of the property owner.

MANAGEMENT 02

Billing and Collecting Rent

Managing monthly rent payments can be time-consuming, and dealing with overdue rent and follow-ups can become a significant mental burden. REDAC handles rent collection on behalf of property owners by issuing monthly statements to tenants. If any rent arrears occur, we will follow up with the tenant. If necessary, we can introduce attorneys to assist with legal procedures, such as rent recovery or eviction, minimizing the owner’s burden as much as possible.

MANAGEMENT 03

Property Inspections and Maintenance

The value of land and buildings is assessed differently in the U.S. compared to Japan. To ensure the success of real estate investments in the U.S., maintaining the property is crucial. The key points are:

1.Conduct regular property inspections to prevent potential management issues.

2.Perform proper maintenance to preserve the property’s value.

With these principles in mind, REDAC conducts regular property inspections. If any issues arise, we promptly assess them and arrange necessary repairs to maintain the property’s value.

MANAGEMENT 04

Quality & Cost Control of Construction Contractors

The quality of repairs and construction required in the U.S. often differs from the standards in Japan. Additionally, delays in project timelines and issues with contractors not following specifications are common in the U.S. At REDAC, we manage these challenges on behalf of property owners, ensuring the quality of work and minimizing any issues with contractors. We also negotiate construction costs on the owner’s behalf, striving to maximize cost-effectiveness.

MANAGEMENT 05

Create Monthly Income Expense Reports

Simplified Expense Management

REDAC opens an interest-free management account in the owner’s name, where collected rent is held. Property-related expenses are paid directly from the account. If the balance exceeds the agreed amount, REDAC can transfer the excess to the owner’s designated account upon request. If additional funds are needed, the owner will be asked to deposit the required amount into the management account.

Easy-to-Understand Monthly Financial Reports

Each month, the owner will receive a detailed financial report summarizing rent income and expenses. This provides a clear overview of the property’s financial status and management performance. Additionally, important updates regarding tenant decisions, lease expirations, and other matters will be reported as needed.

Hassle-Free Payment of Recurring Expenses

REDAC handles the payment of recurring expenses such as property taxes, insurance premiums, utilities, and mortgage payments, relieving the property owner of these tasks.

Support for U.S. Tax Filing

While U.S. income tax filing is the owner’s responsibility, we can introduce accountants upon request. For properties managed by REDAC, we offer a service that compiles the necessary data for tax filings and forwards it to the accountant (this service is available for an additional fee). Please feel free to contact us for assistance.

MANAGEMENT 06

Risk Management

Introduction of Attorneys for Eviction or Legal Actions

In case of rent arrears or other issues, we can introduce attorneys to assist with rent recovery or eviction lawsuits, if necessary.

Assistance with Insurance Enrollment

We provide consultation and assistance with enrolling in necessary insurance policies, such as property damage insurance and liability rental insurance.

Management Fees

Management fees vary depending on factors such as location, property condition, and expected rental income. Based on these factors, we will provide a comprehensive assessment and present the monthly management fee.

OTHER BUSINESS